Largest capacities Russian production alumina is concentrated in the Urals (Bogoslovsky and Ural aluminum smelters) and in Eastern Siberia (Achinsky alumina refinery, operating on nephelines from the Kiya-Shaltyrskoye deposit).

In terms of scale of production and consumption, aluminum ranks first among non-ferrous metals in the world economy. The qualities of aluminum, such as light weight and lack of magnetic properties, are especially important for aviation, electronics and shipbuilding; non-toxicity and moisture resistance - for the food industry and packaging materials industry, and immunity to the destructive effects of air, temperature and humidity (corrosion) - perfect quality for the transport and construction industries.

Raw material base

The raw material for the aluminum industry is bauxite, an ore consisting mainly of aluminum hydroxides (Al2O3). The leaders in bauxite mining in the world are Australia, Guinea, Brazil and Jamaica - tropical countries where weathering crusts rich in aluminum were formed. Bauxite mines in Russia have a significantly worse quality of raw materials; the ore is characterized by a low aluminum content and an abundance of foreign impurities. Currently, bauxite mining is carried out by 3 enterprises: JSC Sevuralboxitrude (Severouralsky bauxite mine, SUBR), JSC North Onezhsky bauxite mine and JSC Boksit Timan (Sredne-Timansky bauxite mine). The cost of mining bauxite in Timan (without transportation costs) averages $20 per ton, SUBR bauxite - more than $26. For comparison, the cost of mining Australian bauxite is from $10 per ton, and Guinean bauxite - from $35 per ton. a ton In 2002, due to unprofitability, production at two other Russian bauxite deposits was stopped - Boksitogorsk in the Leningrad region. and at the South Ural bauxite mines in the Satkinsky district of the Chelyabinsk region.

Another type of aluminum raw material - nephelines is mined in the south Krasnoyarsk Territory(Kiya-Shaltyrskoye deposit) and on the Kola Peninsula (as part of apatite-nepheline ores).

Alumina production

Aluminum cannot be obtained directly from its ores (bauxite and nepheline); a transition stage is required - the production of alumina. Alumina is a fine, steel-gray powder containing aluminum oxide in concentrated form. Alumina production, being material-intensive, gravitates towards sources of raw materials. To produce 1 ton of alumina, about 3 tons of bauxite or 4-6 tons of nephelines are required. Only 40% of Russia's needs for alumina are provided by domestic raw materials, the rest comes from abroad (from Guinea, Jamaica, etc.).

The largest Russian alumina production facilities are concentrated in the Urals (Bogoslovsky and Ural aluminum smelters) and in Eastern Siberia (Achinsky alumina refinery, operating on nephelines from the Kiya-Shaltyrskoye deposit). A special feature of the production of alumina from nephelines is the large yield of by-products: cement, soda, potash. Only with them effective selling Alumina produced from nephelines can compete with that produced from bauxite.

Metallurgical processing

The production of aluminum metal is very energy intensive, as it involves very high temperatures metallurgical process. It is because of this property that aluminum, despite its prevalence, began to be used by humans relatively late. Aluminum smelters rely on powerful sources of cheap electricity, most often large hydroelectric power plants. The world's largest Bratsk aluminum plant is located near the Bratsk hydroelectric power station. The Krasnoyarsk aluminum smelter is located next to the Krasnoyarsk hydroelectric power station and consumes about 70% of the total amount of electricity produced by the station. Energy supply to aluminum smelters in Sayanogorsk, Volgograd, Shelekhov, Volkhov, Novokuznetsk is provided by the Sayano-Shushenskaya HPP, Volzhskaya HPP, Irkutsk HPP, Volkhovskaya HPP and a group of thermal power plants operating on thermal coal from Kuzbass, respectively.

Domestic aluminum industry divided between two large companies - Russian Aluminum and Siberian-Ural Aluminum.

Russian Aluminum JSC (RUSAL) is one of the world's three largest aluminum companies, second only to the American Alcoa and the Canadian Alcan. It accounts for more than 80% of Russian and about 10% of global production of primary aluminum. RUSAL owns the largest and most modern metallurgical enterprises in the industry: Bratsk, Krasnoyarsk, Sayanogorsk and Novokuznetsk aluminum smelters, alumina refineries in Nikolaev (Ukraine) and Achinsk, metalworking enterprises in Samara, Belaya Kalitva, Dmitrov.

The Siberian-Ural Aluminum (SUAL) holding produces 90% of Russian bauxite, 60% of alumina, 20% of primary aluminum. This structure includes the remaining 7 of the country's 11 aluminum smelters, as well as the Severouralsky and Sredne-Timansky bauxite mines; alumina production facilities in Krasnoturinsk, Kamensk-Uralsky, Pikalevo; metalworking industries in Mikhailovsk, Kamensk-Uralsky, etc.

The demand for aluminum will increase in the coming years, so both of the largest aluminum companies in our country have ambitious plans to expand the production base at each of the three stages of aluminum ore processing.

The SUAL Group is currently working on a project for the construction of the Komi Aluminum aluminum-alumina complex in the area of Ukhta (Komi Republic). The complex includes a bauxite mine, alumina and aluminum plants, which will allow for a full production cycle - from the extraction of raw materials to the production of metal. Significant and easily accessible reserves of Russia's largest Sredne-Timan deposit, located 270 km from the designed complex, will be used as raw materials. Annual production volumes are estimated at 6 million tons of bauxite, 1.4 million tons of alumina, 300-500 thousand tons of primary aluminum.

In the Murmansk region, SUAL plans to build the second stage of the Kandalaksha aluminum smelter, with an estimated capacity of 230 thousand tons of primary aluminum and its alloys per year.

Currently, the possibility of building an alumina refinery in the Arkhangelsk region is being considered. based on the North Onega field (RUSAL project). The projected capacity of this enterprise is 1-1.5 million tons per year.

The views of the management of Russian Aluminum are also directed towards Russia’s closest neighbors. The company intends to build an aluminum smelter in Kyrgyzstan and finance the construction of power plants necessary for the future enterprise. Previously, RUSAL announced plans to build a new aluminum plant in Tajikistan, the second after the existing Tajik AZ in Tursunzade (by the way, it should also be part of the RUSAL empire in the future), as well as its desire to invest in the completion of the Tajik Rogun hydroelectric power station. The same company announced its intentions to build aluminum and alumina plants in Kazakhstan.

Internet source:

http://geo.1september.ru/2005/03/23. htm

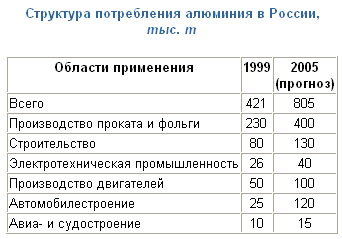

And a number of other branches of the engineering and metalworking industries, as well as construction, railway transport, chemical, and food industries.

Story

Development and location of the aluminum industry in the world

Raw material base

Bauxite is the main mineral raw material for the aluminum industry. Its reserves in the world are distributed very unevenly and are limited. There are seven bauxite-bearing areas in the world:

- Western and Central Africa (main deposits in Guinea);

- South America: Brazil, Venezuela, Suriname, Guyana;

- Caribbean: Jamaica;

- Oceania and southern Asia: Australia, India;

- Mediterranean: Greece and Türkiye;

Understanding the importance of the raw material base, the world's largest aluminum producers divided the main bauxite deposits High Quality, with an alumina content of at least 50%. Other companies can either purchase alumina at open market and be entirely dependent on market price fluctuations, or join forces with deposit owners

Major aluminum producers in the world

List of countries with largest aluminum producers

According to the US Geological Survey, the largest aluminum producers in the world in 2010 were the following countries:

| Place | A country | Aluminum production in 2010, thousand tons | Annual production capacity, thousand tons |

|---|---|---|---|

| 1 | China | 16800 | 18400 |

| 2 | Russia | 3850 | 4280 |

| 3 | Canada | 2920 | 3020 |

| 4 | Australia | 1950 | 2050 |

| 5 | USA | 1720 | 3190 |

| 6 | Brazil | 1550 | 1700 |

| 7 | India | 1400 | 2300 |

| 8 | United Arab Emirates | 1400 | 1650 |

| 9 | Bahrain | 870 | 880 |

| 10 | Norway | 800 | 1230 |

| 11 | Republic of South Africa | 800 | 900 |

| 12 | Iceland | 780 | 790 |

| The whole world | 41400 | 49000 |

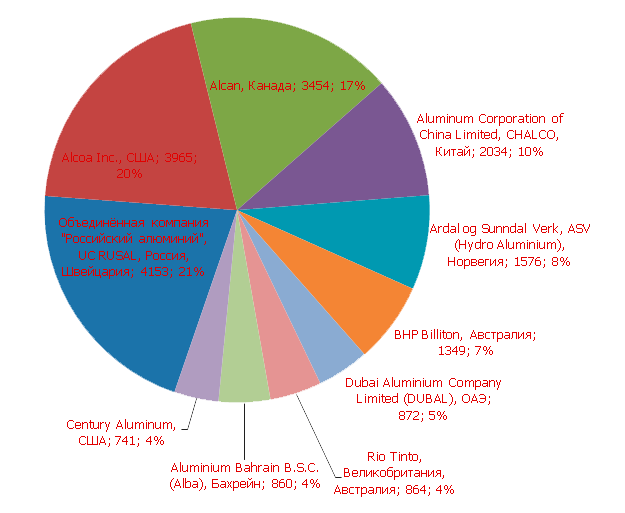

List of companies - largest aluminum producers

The ten largest aluminum producing companies are as follows:

| Place | Company name | A country | Production volume, thousand tons |

|---|---|---|---|

| 1 | United Company "Russian Aluminum", UC RUSAL | Russia, Switzerland | 4153 |

| 2 | Alcoa Inc. | USA | 3965 |

| 3 | Alcan | Canada | 3454 |

| 4 | Aluminum Corporation of China Limited, CHALCO | China | 2034 |

| 5 | Årdal og Sunndal Verk, ASV (Hydro Aluminum) | Norway | 1576 |

| 6 | BHP Billiton | Australia | 1349 |

| 7 | Dubai Aluminum Company Limited (DUBAL), | United Arab Emirates | 872 |

| 8 | Rio Tinto | UK, Australia | 864 |

| 9 | Aluminum Bahrain B.S.C. (Alba) | Bahrain | 860 |

| 10 | Century Aluminum | USA | 741 |

The largest aluminum production enterprise is the Bratsk Aluminum Plant, which was the first in the world to produce more than 1 million tons of aluminum per year. The plant produces 30% of Russian aluminum and 4% of global aluminum. The plant consumes 75% of the electricity generated

Global aluminum consumption in 2014 increased by 7% compared to 2013, mainly due to strong growth in demand in North America and China in the fourth quarter of 2014. At the same time, demand for aluminum in fast-growing markets, including Russia, Latin America and India, was more restrained.

In the first half of 2015, global aluminum demand increased by 6.3% to 27.8 million tonnes, driven by higher demand in North America and the EU. Among the BRIC countries, India made the largest contribution to the growth in aluminum demand.

Demand for aluminum in North America increased by 4.6% in the first half of 2015 compared to the same period last year. According to the Aluminum Association, orders from rolled steel producers have risen 5.8% since the beginning of the year, while shipments of aluminum extrusion products by American and Canadian producers have increased by 9.0%. In the first half of 2015, demand for aluminum in Europe increased by 2.5% compared to the same period last year. The key fast-growing markets were Turkey, Italy, France and Germany, where consumption increased by 6.1%, 2.6%, 2.4% and 1.1% respectively.

Aluminum consumption in Asia, excluding China, increased by 1.8% in the first half of 2015 compared to the same period last year.

Negative trends include a decrease in volumes industrial production in Japan - in May it amounted to 4% compared to the same period last year, which is associated with a slowdown in the transport equipment segment and automotive production. Industrial production volume in South Korea in May decreased by 2.8% compared to last year and by 1.3% compared to the previous month.

Aluminum consumption in China in the first half of 2015 amounted to 14.2 million tons, an increase of 9.3% compared to the same period last year. China's GDP grew by 7% year on year in the second quarter of 2015, exceeding analysts' expectations.

In 2015, global demand for aluminum is expected to grow by 6%, or 58 million tons.

Page 4 of 6

The predominant raw material for obtaining alumina for the further production of aluminum is bauxite (aluminum ore). To produce one ton of aluminum metal, about `1930 kg of alumina, `550 kg of carbon electrodes (baked anodes or anode mass), `50 kg of fluoride salts and approximately 18,000 kWh of electricity are used. The aluminum industry is quite energy intensive, so an important condition its promotion is the availability of powerful sources of electricity at a low price.

Raw material base

As we wrote above, bauxite is the predominant natural mineral raw material for the aluminum industry. Its global reserves are distributed extremely unevenly and are quite limited. There are only seven bauxite-bearing areas in the world:

Central and West Africa mainly deposits in Guinea;

South America: Venezuela, Brazil, Suriname, Guyana;

Central America: Jamaica;

Oceania and southern Asia: India, Australia;

China;

Mediterranean: Türkiye and Greece;

Russia: Ural.

The importance of the raw material base is great, and the largest aluminum producers in the world understand this.

The owners divided the main deposits of bauxite with an alumina content of at least 50%. Other producers can either buy high-quality alumina on the open market and be entirely dependent on market prices, or join forces with the owners of bauxite deposits.

Big Ten Aluminum Manufacturing Companies

The largest aluminum producer is the Bratsk Aluminum Plant. The plant produces 4% of the world's aluminum and 30% of Russian aluminum. It was the first in the world to produce more than 1 million tons of aluminum per year.