The loss of a breadwinner means his death or unknown absence, which must be confirmed by relevant documents. In the absence of documents, these facts can be established by the court in accordance with the Civil Code of the Russian Federation.

Citizens of the Russian Federation who have not reached 18 years of age have the right to a pension even if they study abroad, regardless of registration at their place of residence. Citizens of the Russian Federation over 18 years of age studying in foreign educational institutions (except for states - former republics of the USSR) have the right to a pension only if they are sent to study in accordance with an international treaty of the Russian Federation. When studying in the former republics of the USSR, the right to a pension is retained.

It is important to note that brothers, sisters and grandchildren of a deceased breadwinner acquire the right to a pension only if they do not have able-bodied parents obligated by law to support them. According to the Family Code of the Russian Federation, deprivation of parental rights, as well as serving a sentence in prison, does not relieve parents of the obligation to support their children.

Disability must occur before the death of the breadwinner, or before the court declares him dead or missing.

Family members of the deceased are considered dependent on him if they were fully supported by him or received assistance from him, which was their constant and main source of livelihood. An assessment of the amount of actual assistance of a deceased breadwinner is made by the territorial bodies of the Pension Fund of the Russian Federation on the basis of available documents (for example, certificates from housing authorities or local self-government bodies about cohabitation, certificates of income of family members, receipts for postal orders, etc.). In the absence of documents, the fact of dependency can be established by the court.

The duration of the dependency is usually not important. An exception is provided for stepfather and stepmother. They acquire the right to a pension if they raised or supported their deceased stepson or stepdaughter for at least five years.

Dependency of children (including adopted children) is assumed and does not require proof. For example, for pension provision, it does not matter the fact that the father lived separately from the children and did not actually provide them with any assistance, that the child was born after the death of the father, or that the child’s mother died during childbirth, etc.

But children declared fully capable must prove the fact of dependency.

If the death of the breadwinner occurred as a result of his commission of an intentional crime or deliberate damage to his health (i.e. suicide), then his disabled dependents do not have the right to a labor pension. They can only apply for a social pension. It is difficult to agree with the position of representatives of the Pension Fund of the Russian Federation, who believe that this norm is due to the insurance nature of the pension system (Zurabov M.Yu. (general editor). Commentary on the pension legislation of the Russian Federation. M: Norma, 2007. P.451-453.) . It can hardly be considered fair for the occurrence of adverse property consequences for persons who did not commit guilty actions. In addition, if the deceased breadwinner worked and contributions were paid for him, which serve as the basis for calculating the labor pension, then it is not clear why the legislator deprived his dependents of the right to a labor pension, the financial means for the payment of which had already been generated.

A completely different situation will arise if the dependents themselves kill the breadwinner. In this case, depriving them of their labor pension will be socially justified.

A survivor's pension is a monthly payment awarded to the disabled dependents of a deceased (absent) breadwinner as partial compensation for the assistance that served as their permanent and main source of livelihood.

Students should know which family members and under what conditions are granted the right to a pension, regardless of the fact of dependency, and be able to explain the concept of “dependency.”

Pension calculation

Unlike labor pensions for old age and disability, a labor pension in the event of the loss of a breadwinner can consist of only two parts - basic and insurance.

For minor children, brothers, sisters and grandchildren of a deceased breadwinner who have lost both parents, or children of a deceased single mother (orphans) from August 1, 2008, the BC is assigned in the amount of 1,794 rubles. per month - everyone. For other disabled family members - in the amount of 897 rubles. per month.

For persons living in the Far North and equivalent areas, the size of the BC is increased by an appropriate factor. When leaving the specified territories, the BC is paid without applying the regional coefficient.

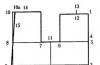

The average labor pension in the event of loss of a breadwinner for each disabled family member is determined by the formula:

SC=PC/(T x K)/KN,

where PC is the amount of the estimated pension capital of the deceased breadwinner on the day of his death. The transformation of pension rights acquired by a deceased breadwinner before 01/01/2002 is carried out according to the rules of Article 30 of the Federal Law of 12/17/2001 using the same formulas as for old-age and disability pensions.

The expected period of payment of the pension (T) is the same as for the old-age labor pension. K is the coefficient that is used when calculating the disability pension.

KN - the number of disabled dependents of the deceased breadwinner who are entitled to a pension.

If the deceased breadwinner was a pensioner and received the insurance part of a labor pension for old age or disability, then the size of the labor pension in the event of the loss of a breadwinner is calculated as the ratio of the insurance part of his pension (SP) to the number of dependents entitled to it:

SCh=SChp/KN.

The amount of the insurance part of the labor pension in the event of the loss of a breadwinner cannot be less than the size of the insurance part of the labor pension in the event of the loss of a breadwinner, which was originally assigned to other members of the family of the deceased breadwinner in connection with the death of the same breadwinner.

If the death of the breadwinner occurred before the accumulative part of the old-age labor pension was assigned to him or before its recalculation, then the funds recorded in the special part of his individual personal account are paid to the persons specified in his application. In the absence of an application, these funds are distributed in the following sequence:

- first of all - to children, including adopted children, spouses and parents (adoptive parents);

- secondly - to brothers, sisters, grandparents and grandchildren.

Payments to relatives of the same line are made in equal shares. Relatives of the second stage have the right to receive only in the absence of relatives of the first stage.

In the absence of relatives, these funds are transferred to the pension reserve, and a special part of the deceased breadwinner’s personal insurance policy is closed.

Assignment and payment of pensions

A labor pension in the event of the loss of a breadwinner is assigned from the date of death of the breadwinner, if the application for it follows no later than 12 months from the date of his death, and if this period is exceeded, 12 months earlier than the date of application.

The pension is paid as long as the family member entitled to it is considered disabled.

When family composition changes, the pension amount is revised in accordance with the number of family members. The new pension amount is provided from the first day of the month following the one in which the specified circumstances occurred. The same rule applies when pension payments are terminated.

A family is provided with one pension regardless of the number of disabled dependents entitled to it. At the request of any family member who has reached the age of 14, his share can be allocated from the first day of the month following the one in which the application for division of the pension was received.

For minors, the right to a pension is retained upon adoption. The spouse of the deceased breadwinner continues to receive a pension upon entering into a new marriage.

Students must be able to determine the size of a labor pension in the event of the loss of a breadwinner and know the rules for assigning it.

Loss of a breadwinner is a legal concept and means the death or long-term absence of a citizen for no known reason, which must be documented. If there is official confirmation, the disabled dependents of the deceased are assigned a monthly insurance payment. It should partially compensate for the income with which the family was financially supported and which was the main source of subsistence.

For any monetary payments, there must be reasons that necessitate their receipt and documentary support for the right to them.

If the necessary conditions are met, citizens have the right to receive an insurance pension benefit:

- Disabled dependent family members of the deceased. This list does not include persons who committed actions that resulted in the death of a citizen.

- Spouse, one of the parents, minor children, disabled dependents who were in the care of the breadwinner.

The concept of disability is also reflected in the legislation and is explained by several features:

- Availability of a disability group and limited ability to work.

- Inability to work due to the need to care for young children under 14 years of age.

- The presence in the family of children under the age of 18, as well as those who continue their full-time education after graduation - up to 23 years.

- Men 60 years old, women 55 years old, without the physical ability to work.

The law outlines a certain circle of persons entitled to receive pension payments:

The law outlines a certain circle of persons entitled to receive pension payments:

- Minor children, grandchildren, brothers, sisters of a deceased citizen.

- Full-time students of educational institutions who are over 18 years of age until they reach 23 years of age.

- Grandparents, spouses, regardless of whether they work or not.

- Brothers, sisters, children of a breadwinner over 18 years of age, caring for small children under 14 years of age and unemployed.

- Unemployed grandchildren of the breadwinner under 14 years of age.

- Parents, spouse of the deceased, who have reached 60/55 years of age or have a disability group.

- Grandparents of the deceased who are 60/55 years of age or younger and are disabled, if they have no relatives to support them.

- Adoptive parents of children and adopted children, while their rights are equal to those of their own children. It is necessary to confirm that the deceased foster parent raised him and supported the child. Minor children who already receive such a pension retain the right to receive it in the same amount if they are adopted by another family.

- The stepmother and stepfather have every right to their share of the payments. They are awarded on equal terms with father and mother. A certificate stating that the minor children of the deceased citizen are in their care is added to the documents for the purpose of payment. The period of care must be calculated for a period of at least 5 years.

Those families in which the breadwinner has disappeared are equal in status and rights to the families of the deceased, if the person’s long absence is qualified by the court as missing.

- The policyholder's work experience is at least 1 day.

- The occurrence of death must not be associated with a criminal act committed by a disabled family member and resulting in the death of the breadwinner.

If the deceased citizen did not work for a single day, disabled dependents are assigned a social pension payment. Its size is set in accordance with the level of the consumer basket for pensioners in the region. The pension should not be lower than this level.

The social pension is also subject to indexation; it is entitled to certain benefits entitled to the holder of the survivor's insurance pension.

About submitting documents for a pension

Providing a package of documents is a necessary action when submitting an application for a pension payment. The citizen submits the package to the regional PF body.

If a pension is assigned in favor of minor children, then their parents or legal representatives must submit documents to establish the right at their place of residence.

The documents required when applying for pension benefits must be submitted in the original form. If copies are provided, they must be notarized.

Conventionally, the entire package can be divided into 2 parts:

- Identity documents, which in turn include:

- Statement.

- Applicant's passport.

- Death certificate.

- Work record book of the deceased (if available).

- Certificate confirming the applicant's relationship with the deceased.

- Supporting information:

- About the average salary of the deceased.

- On guardianship or adoption of minor children.

- Confirmation that a dependent over 18 years of age is continuing education.

- Confirmation of disability.

- Confirmation of adoption of children.

This list of certificates is far from complete; it is basic, but not all certificates may be mandatory. Each case of assigning an insurance pension for the loss of a breadwinner is individual and requires personal consideration.

The assignment of payment of the insurance portion for the loss of a breadwinner occurs from the date of death. On the day the package of documents is submitted, they are registered by the responsible person and submitted for review to PF specialists. The application must be submitted within 1 year from the date of death of the citizen.

The assignment of payment of the insurance portion for the loss of a breadwinner occurs from the date of death. On the day the package of documents is submitted, they are registered by the responsible person and submitted for review to PF specialists. The application must be submitted within 1 year from the date of death of the citizen.

Alternatively, you can send documents by mail to the address of the authority that assigns pensions. The day of application will be considered the date of dispatch of the parcel on the postmark. If the submission was made online through the portal of the Pension Fund of the Russian Federation, then the countdown date will be the date of filling out the application form on the website.

PF specialists are required to review the application and documents within 10 days. If the package is missing some certificates, they must notify the applicant about this. He will be given 3 days to provide the missing documents.

An insurance pension in connection with the loss of a breadwinner is issued once for the entire period for which the payments are calculated. The payment end period cannot be regulated equally for everyone. Its establishment depends on the categories of dependents for whom the right to payments is issued. In each individual case, the PF employee must inform the applicant about the validity period of the payments.

On the appointment of an insurance pension for the loss of a breadwinner

Insurance payments are calculated using a special formula, which takes into account the breadwinner (IPC) and the cost of the pension coefficient on the day the pension was assigned (PC). PC is determined by government decision and is based on economic calculations.

To calculate the insurance part, the individual coefficient and the cost of one PC are multiplied, as a result the amount of the insurance part is determined.

The Pension Fund is responsible for the calculation and payment of the insurance portion in the event of the loss of a breadwinner, and it also provides citizens with a pension at their place of residence or by transferring funds to a bank account.

The Federal Law of the Russian Federation defines the procedure for establishing, paying and delivering pensions:

The Federal Law of the Russian Federation defines the procedure for establishing, paying and delivering pensions:

- List of required documents.

- Rules and points for applying for appointment.

- Rules for the appointment, establishment, recalculation of pensions.

- Rules for transferring pensions from one type to another.

- Rules for the payment of the pension itself, its fixed part, control over their timely assignment and payment.

- Rules for maintaining documentation related to all pension procedures.

About the prospects for increasing payments

The size of the pension should increase annually by 2% of the pension amount in accordance with the legislation of the Russian Federation. On average, the value ranges from 5 to 7%. In the context of the economic crisis in the country, indexation will decrease significantly.

From 04/01/16, the insurance pension for the loss of a breadwinner increased by 4%. In monetary terms, there was an increase in the range from 150 to 450 rubles.

In past years, increased indexation was practiced twice a year, but there is no information whether the assigned payments will be indexed additionally this year. Further increases in pension payments will depend on the economic situation in the country based on the results of the first half of the year.

Therefore, according to analysts’ forecasts, the current size of the survivor’s insurance pension will be frozen at this level until approximately 2018.

When a person who is the breadwinner dies, this means that the family loses part of its impressive income. In order to at least somehow compensate for such a financial loss, the state has provided a special pension provision.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

It is also subject to regulation by legislation, like other types of insurance pensions. It is the law, as well as other legal acts, that contains the procedure and rules for assigning such benefits, what documents should be submitted, under what conditions and what the amount of such a pension is.

What it is

The insurance pension for those whose benefactor died while supporting family members is the provision of an insurance type pension.

It should be assigned strictly to those persons who are disabled citizens - members of the family of a deceased working breadwinner.

These may be minors, family members with physical or mental disabilities who cannot work either permanently or for a certain period of time.

For example, minor children can receive the insurance pension of their deceased father until he reaches not only the age of majority, but also other limits.

Thus, for students whose father has died, who are full-time students at a state educational institution, a pension will be assigned when they reach 23 years of age. As with any rules, there are also exceptions.

Such a pension cannot be assigned to citizens who are dependents, however, convicted of committing an intentional crime, which inevitably resulted in the death of the breadwinner.

The insurance part of the benefit is taken from the labor benefit - that which the deceased breadwinner managed to earn during his life.

The labor pension includes three parts:

- basic;

- insurance;

- cumulative.

The basic part refers to the state pension benefit. The second part is insurance, this is the main percentage of those contributions that his employer once made for the employee.

And the third - cumulative, also applies to part of the insurance contributions from the employer, only today they are either indexed and transferred automatically to the insurance part, if the policyholder did not manage to transfer it to a non-state fund institution before April 2019.

And if the breadwinner managed to re-register the accumulated part of the pension before his death in a non-state pension fund, then this part will belong to the heirs.

The survivor's insurance pension consists of the following parts::

- the capital of the deceased (in total for the pension) for his insurance period of work - to determine the amount of the insurance pension for the loss of a breadwinner is always taken into account;

- the basic amount of state pension provision, fixed, which is always present in almost all types of pensions;

- an additional type of survivor's benefit may not be assigned in all cases;

- social benefits in the form of a pension may also not always be determined.

To summarize, we can say that the insurance pension assigned in the event of the death of the breadwinner to members of his family includes two parts - basic and insurance.

It represents monthly payments either until a certain age, when a family member can earn for himself, or for life if the family member is disabled.

Conditions of appointment

The general conditions for the payment and assignment of pension benefits to dependents after the death of their breadwinner are the following:

- The established fact of the death of the breadwinner or his unknown disappearance, which is confirmed by relevant documents.

- The deceased must have at least some insurance coverage. To do this, he must be registered with the Pension Fund as an insured person.

- Recognition of one or another family member supported by the breadwinner as disabled, which must also be confirmed by documents.

- Providing documents confirming that the dependent was supported by a breadwinner who recently died.

Survivor insurance pensions are paid in accordance with the law of December 28, 2013, the edited version came into force on January 1, 2019.

Article 10 of this legislative act spells out the conditions under which assignments are made to families who have lost their breadwinner.

This applies, first of all, to families that are recognized by social protection in the Russian state as low-income; members of such families may be disabled citizens or dependents requiring regular financial assistance.

For disabled persons who are members of a family where the breadwinner died, the law defines:

- children of the deceased who are minors;

- brothers, sisters, grandchildren who are also under 18 years of age;

- studying children, grandchildren, brothers, sisters who are not yet 23 years old and continue to study in a state-type educational institution;

- minor family members who have already received a disability before reaching adulthood;

- minor citizens are allowed to receive the insurance pension of the deceased breadwinner if their parents or parent are disabled;

- guardians who have lost their breadwinner, support young children and themselves work for valid reasons;

- parents, grandparents or spouse of the person who died and was the breadwinner in the family who have reached 60 or 55 years of age;

- grandfather, grandmother, parents or spouse who have reached 60 or 55 years of age and have a disability;

- adoptive parents receive the right to switch to this type of support after the death of the breadwinner in the same way as natural parents, as well as adopted children, who receive the right to benefits on an equal basis with natural children;

- In relation to a stepfather, mother, stepson or stepdaughters, the law applies on the same basis as the laws for natural family members - they have the right to receive an insurance-type breadwinner's pension, but under special conditions.

Those who are assigned such a pension must necessarily fall into the category of persons who were dependent on the deceased breadwinner. Being dependent means constantly needing maintenance and help from the breadwinner.

Typically in Russia, dependents themselves also receive their social pension, as a benefit for disabled people or citizens in a weakly protected group of the population.

It is to them, those who already receive their pension, that the state grants the right in the event of the death of the breadwinner to transfer to his pension - an insurance pension, if it is larger.

In addition, even after remarriage, a widow or widower has the right to continue to receive the deceased spouse's insurance pension.

Only in this case should you first re-register the receipt of his insurance coverage in your last name, and only then remarry or get married.

After the dissolution of the second marriage or the death of the second spouse, the lost right to receive a pension for the first deceased spouse cannot be restored.

In total, the pension is assigned first to the children of the deceased (even adopted ones), then to the spouse, then to the parents, and after them it may be the turn of brothers, sisters, grandparents or grandchildren.

How to register

You can apply for a pension that once belonged to a deceased breadwinner at any time.

No deadlines limit those who have already entered into the right to receive or transfer to the pension provision of a deceased spouse, parent or breadwinner in a different social status.

In order to begin the process of registering an insurance pension in your name and surname, you will need to contact the territorial authority of the Pension Fund of the Russian Federation closest to your place of residence.

It is imperative to comply with the condition - the institution must be in the region, district, locality where you have permanent or temporary registration.

In addition to the Pension Fund of Russia, citizens on this issue can also contact the MFC - a multifunctional public service center.

For persons living not at their registration address, but at their actual place of residence, it is also allowed to apply to the territorial Pension Fund of the Russian Federation at their place of residence. When applying, submit an application in standard written form.

Other documents are also attached to it, which can either be handed over personally to the fund inspector or sent by regular mail - a letter with notification, registered.

If the legal successor of the insurance pension cannot move on his own (is disabled or ill for a long time, for example), then the law allows accepting documents from his representative.

In this case, it is important for the representative to also present a power of attorney certified by a notary. When you submit documentation by mail, then in this case the day you contact the PFRF will be the one indicated on the postmark.

For Russian citizens who stay outside the Russian Federation for some time and do not have temporary or permanent registration in Russia, they have the opportunity to submit a package of papers directly through the central Pension Fund of the Russian Federation. Such a fund is located at the capital's address: 119049, Russia, Moscow, st. Shabolovka, 4.

In addition, today the official website of the Pension Fund of Russia opens access to accepting documents in electronic form through its personal account.

Citizens registered on the website receive access to their personal account. To do this, you will need to go through all stages of registration with confirmation of an electronic signature and identification card, with the sending of passport data or a scan of your passport.

Required documents

The package of documents that will need to be presented to the Pension Fund for consideration of your case on the assignment of an insurance type pension in connection with the death of the breadwinner may contain both the personal data of the dependent and the evidence base of the fact of the death of the breadwinner.

Therefore, do not be surprised if, when accepting documentation, an employee of a government pension institution asks you to sign a document indicating your consent and approval of the processing of your personal data strictly within the framework of government agencies.

A package of documents should be prepared with the following content:

- with a request to assign a breadwinner's pension to the name of the insured person who is the legal successor. It is not drawn up arbitrarily, but must be written on a special standard form, which must be given to the applicant by government agency employees at the pension fund;

- a copy and original of a civil passport or residence permit, if the applicant does not have citizenship of any country or is temporarily residing in Russia under the status of “temporary residence” (not “temporary stay”, namely “temporary residence”);

- SNILS or a certificate confirming that the applicant is also an insured citizen;

- papers on the death of the breadwinner - certificate;

- evidentiary documentation of the applicant’s relationship with the deceased breadwinner;

- papers that can confirm the insurance and work experience of the deceased breadwinner:

- document on the duration of the insurance period;

- orders, personal accounts, extracts from personal files, cards, certificates of periods of work from the employer;

- any other documents that an employer usually issues when dismissing an employee.

- other documents that the Pension Fund employee may request for additional confirmation of a particular factor.

If you manage to deliver all the necessary additional papers to a specialist at the Pension Fund within 3 months from the date of filing the application, then the date of application to the fund for the assignment of a breadwinner's benefit will be determined by the date indicated in your application.

By law, your application must be considered no later than 10 days (working days), if you have brought all the necessary documents.

All documentation that a Pension Fund specialist has the right to require is defined in specially developed Regulations approved by the Order of the Ministry of Labor of the Russian Federation dated March 28, 2014.

Conclusion

A document such as a conclusion on the assignment (recalculation) for payment of an insurance pension in connection with the loss of a breadwinner may be needed when you are going to apply for it through the government service website.

The design algorithm there is as follows:

- First, the site visitor must make sure that he is an insured citizen.

- Then you should register on the State Services website.

- After this, you should fill out an application on the form that is available on the website. It can be found through your personal account.

- All necessary electronic documents are attached to the application.

- After all the data has been entered and a package of documents has been sent, the system will process your request through the database of the Social Security Administration of the Russian Federation.

- When your request is approved, you will see in your personal account that the status of your request will be changed. If the application is rejected, the status will also change to appropriate, only additional information will be added to it about what needs to be corrected for the next application.

- After everything has been successfully completed, you will be sent by e-mail or regular mail (depending on what you indicated in the application, in the method of sending you documents) a conclusion that confirms the assignment of pension payments to you - the pension of the deceased breadwinner.

Subjects of the survivor's insurance pension can always familiarize themselves with all the results of their request in their personal account on the State Services portal.

If you refuse, of course, the conclusion on the assignment of insurance pension benefits due to the loss of a breadwinner will not be sent.

Basically, they can refuse if a citizen asks to issue two pensions - his own pension and the person who was dependent on him during his life.

In addition, any discrepancy in the documents or discrepancy with reality is also a reason for refusing to grant such an applicant an insurance pension.

Amount of insurance pension in case of loss of a breadwinner

When calculating a social-type pension for those who have lost their breadwinner, so that they can receive his pension, a special formula is used. According to the law, the size of the pension assigned in connection with the deceased breadwinner has different options. It all depends on the categories of persons who are going to receive a breadwinner’s pension.

You can mark the list of categories of legal successors and the amount of their pensions:

Such special categories of persons who live in underdeveloped areas or dangerous areas will always receive a pension taking into account those coefficients that are recognized by federal laws in their region.

As a rule, such coefficients significantly increase the size of the pension. For example, residents of the Far North may receive an increased pension due to the harsh living conditions in this region.

If you need to start processing an insurance pension for a breadwinner who has died, you should remember that the deadline for submitting an application to the Pension Fund in this case is not defined by law. This means that the application can be submitted at any time.

The collection of documents should be done in advance so that the Pension Fund does not refuse to assign security the first time.

Also, due to changes in pension legislation regarding the funded part of the benefit, the amount of the insurance payment for the loss of a breadwinner will fluctuate, depending on where the “owner” of his pension has allocated the funded part.

Survivor insurance coverage is one of the. The main purpose of this payment is to compensate the state for the disabled family members of the deceased for lost funds due to the death of the insured person supporting them. First of all, children and others have immediate family.

The survivor's pension is assigned for the entire time the recipients are disabled, there may be cases of its indefinite appointment. But it is worth keeping in mind that this insurance payment may be due for certain reasons.

Types of pension insurance in the Russian Federation

As part of the implementation of the strategy for the early development of the pension system, the Ministry of Labor and Social Protection developed completely new principles for calculating pensions. The new legal regulation of the pension system does not contain the concept "labor pension". It has been replaced by two payments that are independent of each other: insurance and savings.

Based on Federal Law No. 400-FZ “About insurance pensions” allocate three types of insurance payments:

- on the occasion of the death of the breadwinner;

To assign all of the above payments, certain conditions must be met.

Thus, all disabled members of his family who supported him have the right to an insurance pension in the event of the loss of a breadwinner. Relatives are recognized as dependents if they were on the full maintenance of the deceased and his assistance was their main source of income. Such a pension is paid as long as the person is declared incapacitated, in some cases for an indefinite period.

A missing person is considered equal to a deceased breadwinner if his absence is documented.

Insurance payments old age are appointed when men reach 60 years of age, and women - 55. In addition to age, they must have at least 15 years of work experience (by 2024) and an individual pension coefficient value greater than 30 (by 2025). If these conditions are met, this pension provision is granted until the end of life.

Right to payment of insurance funds on disability have citizens recognized by federal institutions of medical and social examination as disabled people of groups I, II and III. To establish this type of pension, the length of work experience does not matter, and the reason for the onset of this disability does not play a role either. In case of complete absence of insurance experience, a social benefit is assigned. Disability insurance pension provision is assigned until the day the right to an old-age pension is established.

Who is entitled to a survivor's pension?

This recalculation is carried out according to the formula:

SP 2 = SP 1 + (IPK i /K/KN xSPK),

- SP 2— recalculation result;

- SP 1— variable payment amount;

- IPCi— individual coefficient of the deceased, taking into account additional insurance premiums;

- TO- the ratio of the number of months of insurance experience of the deceased breadwinner on the day from which the pension is assigned to 180 months;

- SPK— the cost of one pension coefficient;

- KN- number of dependents.

For children, this recalculation has a number of features: for children who have lost both parents, the IPC of the deceased is summed up, for children who had one parent it is doubled.

Minimum pension in 2017

As established by law, a citizen’s pension provision cannot be lower than the established subsistence level (ML). If for some reason the insurance payment turns out to be less than it, then along with it is also established social supplement. It can be appointed to the level of regional PM, if in the region of residence it is higher than at the federal level. It is assigned along with the pension and is valid throughout the entire pension provision. by law “On the federal budget for 2017” established the PM value for assigning a social supplement at the level 8540 rubles.

If the deceased breadwinner did not have a single day of work experience, then dependents are assigned a social pension. The minimum amount of such payment is - 4959.85 rubles, for orphans - 9919.70 rubles.

The procedure for payment of pension benefits for the loss of a breadwinner

Payments of pensions in connection with the death of the breadwinner are made every month after appointment. A pensioner can receive money either personally or through a proxy (for this you need to issue a power of attorney), or to a bank account.

- One of the parents or a guardian can receive money for the child.

- However, upon reaching 14 years of age, a minor has the right to receive funds independently.

If the child is an orphan and is in a special institution, then payments are transferred to his personal account.

The recipient of the insurance pension himself chooses the method of delivery of the funds assigned to him. Methods for delivering pension benefits:

- post office;

- bank;

- delivery organization.

All of the above institutions provide a choice of several ways to receive money (in person at the branch, at home, by bank card, etc.).

A pensioner can change the organization and method of delivery of cash payments at any time; to do this, he must submit an application to the Pension Fund.

Termination and suspension of payments

Based on Article 24 of the Federal Law “About insurance pensions” payments may be suspended, If:

- The pension recipient does not receive the funds due to him for 6 months.

- The child has reached the age of majority and there are no documents confirming his full-time education in government institutions.

In these cases, receiving a pension can be resumed if the above situations are eliminated (submission of a certificate of full-time study, etc.), for this you need to write an application to the Pension Fund and provide the necessary documents.

Based on Article 25 of the law “About insurance pensions” payments may be discontinued when:

- The death of a pensioner, as well as his recognition as missing.

- Expiration of 6 months from the date of suspension of payments.

- Loss of the right to a pension by a pensioner (reaching 18 years of age, resuming work).

- Refusal to receive payments.

It is worth keeping in mind that if circumstances change related to the termination of pension payments, the transfer of funds may be restored.

Summarizing the meaning of pension definitions in modern pension legislation, we can come to the following conclusion. On the one hand, for a survivor's pension there are five general characteristics that apply to all types of pensions: 1) frequency of payment; 2) payment from the Pension Fund or the federal budget; 3) state-legal nature; 4) taking into account the labor contribution of the citizen and the social factor; 5) the size of the pension is commensurate with the citizen’s earnings. At the same time, the survivor's pension occupies a special place in the pension system. First of all, this is due to the fact that if the subjects of provision of old-age or disability pensions are citizens who have reached retirement age and disabled people, then in pension provision in the event of the loss of a breadwinner, a new subject of provision appears - family members, which entails the emergence of specific features , inherent only to this type of pension. Thus, pensions in the event of the loss of a breadwinner fully comply with such features characteristic of pensions in general, such as the frequency of payment, payment from the Pension Fund of the Russian Federation and the federal budget, and state-legal nature. However, when taking into account the labor contribution of a citizen and the social factor, it is not the labor contribution of the pension recipient himself that is taken into account, but the deceased breadwinner. In this case, the social factor concerns pension recipients - family members of the deceased breadwinner. As can be seen from the above, in pension provision in the event of the loss of a breadwinner we are talking about two subjects: 1) the breadwinner, who is no longer alive on the day the issue of granting a pension is decided (or he was declared dead or missing by the court); 2) family members of the deceased breadwinner. At the same time, legal facts as conditions for the emergence of the right to a pension apply both to the breadwinner himself and to members of his family.

The loss of a breadwinner is understood as his death or unknown absence, which is confirmed by a death certificate issued by the registry office or established by the court. If the court establishes the fact of the unknown absence of a citizen, then a death certificate is not issued; the basis for assigning a pension will be a court decision that has entered into legal force.

To assign a pension, it is necessary that the breadwinner has worked in the past, been an individual entrepreneur, etc. (in other words, was subject to compulsory pension insurance), or served in military or law enforcement service. As for family members, they must: 1) be included in the circle of family members established by the relevant Federal Law; 2) as a rule, be disabled; 3) be dependent on the breadwinner.

The next specific feature of this type of pension is the period during which it is paid. A survivor's pension is assigned for the period of incapacity for work of family members or for life.

Another important distinguishing feature is the intended purpose of the pension. The survivor's pension is the main or one of the main sources of livelihood for the recipients of this pension for family members.

Taking into account the above, we can give the following definition of a survivor's pension.

Survivor's pension - a monthly cash payment made by the state from the Pension Fund of the Russian Federation or the federal budget to disabled family members of the deceased breadwinner, subject to the conditions provided for by law relating to both the deceased citizen and his family members. The pension is commensurate with the earnings of the deceased citizen, is assigned for the period of incapacity for work of his family members or for life and is the main or one of the main sources of their livelihood.

The importance of a survivor's pension in the life of society is manifested in its functions. The functions of a survivor's pension are similar to those of old-age and disability pensions. The following functions should be highlighted: provisional, protective, compensatory, labor force reproduction, socio-psychological.

Survivor pensions can be divided into three main types (classification is made on two grounds: 1) regulatory legal act; 2) security subject):

- 1) according to the Law on Labor Pensions:

- a) pensions in case of loss of a breadwinner for the families of insured persons;

- 2) according to the Law on State Pensions:

- a) pensions in the event of the loss of a breadwinner for the families of conscripted military personnel;

- b) pensions in case of loss of a breadwinner to the families of citizens affected by radiation or man-made disasters;

- c) pensions in the event of the loss of a breadwinner for the families of citizens from among the astronauts;

- 3) according to the Law on Pensions for Military Personnel:

- a) pensions in the event of the loss of a breadwinner for families of military personnel under contract;

- b) survivors' pensions for families of law enforcement officers.